Enhancing the Customer’s Experience is a Necessity

The insurance industry is currently facing a digital-driven and consumer-led disruption similar to those faced by the retail, banking, media, and entertainment industries in the past.1 As a result, customer experience is increasingly taking the front seat, with customers expecting a personalized engagement to best utilize the products/services benefits.

Customer retention is a significant problem faced by the Insurance industry globally. In fact, a global Insurance industry survey1 revealed that over the past 18 months, an average of 1 in 3 customers terminated or changed their existing carrier. Poor penetration makes it difficult for Insurers to sustain fierce competition and meet ever-changing customer expectations, and a lack of relevant communication further distances companies in the industry from their customers. Add to this the fact that acquiring new customers costs companies in the industry approximately 13 times more than what would be required to retain existing ones and the issue becomes crystal clear: Insurance companies MUST prioritize the customer experience.

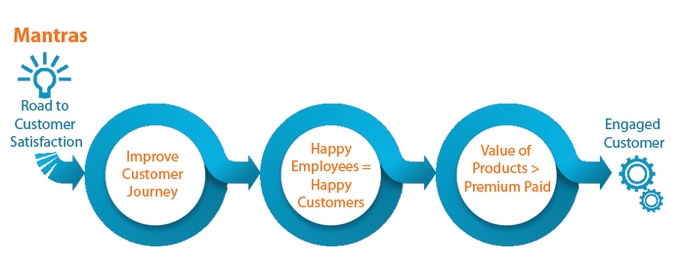

What does it take to retain customers? There are three key mantras that Insurers need to focus on to solve this crucial business problem:

In this article, we will focus on first mantra—improving customer journey. The treatment of the customer during her engagement with the insurer at all key touch points plays a vital role in the customer’s decision to continue with the existing carrier or switch to another one. The focus should be on making the entire customer journey, from onboarding to termination, a pleasant one.

In a typical Insurance company, the customer journey comprises 3 major phases.

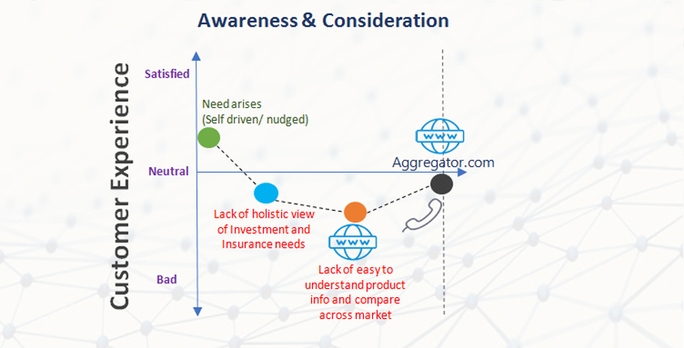

Awareness and Consideration Phase

In this phase, customers are determining their own needs and exploring various products and services options to fulfill their requirements. The major challenge of this phase is the lack of connection between customer needs and available Insurance products. Personal engagement allows a company to understand the customer’s requirements and to recommend the best product matching their needs. Insurers can utilize advanced analytics to:

- Better understand customer needs and devise products/services recommendations

- Build marketing campaigns based on target customer personas

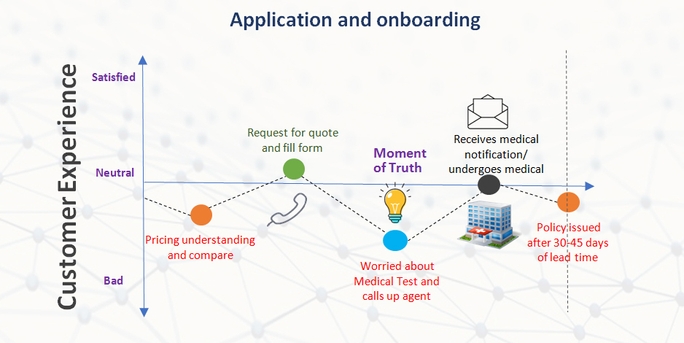

Application and Onboarding Phase

Finding the right product at the right price is a big challenge in this phase and an arduous underwriting process makes things even more complicated and frustrating for customers. Proper communication with customers can help agents better understand their needs, which will eventually lead to finding the most appropriate product at the right price for the customer. Companies globally are using data science and automation to improve the accuracy and efficiency of the complex and lengthy underwriting process. Also, efforts should be made to improve transparency and reduce the complexities involved in onboarding the customers.

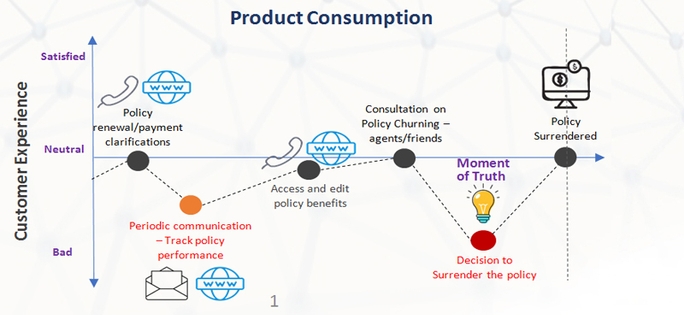

Product(s) Consumption Phase:

In this phase, the major challenge is the customer’s inability to get a clear and accurate view of the product performance. Lack of appropriate engagement with customers in this phase substantially increases the chance of customer terminating the policy. The key to improving the customer’s experience in this phase is to initiate strategic engagement with customers and provide a fair and accurate picture of the product performance.

Advanced analytics can help insurance companies better understand customers, which in turn can drive effective customer engagements. This approach could leverage internal customer data along with the external market data to develop an analytics engine to predict the customer behavior upon utilization of the product. This would enable the customer engagement team to proactively and strategically engage with customers who are predicted to demonstrate adverse behavior.

One of the major shortfalls we have seen in insurance companies is the lack of sophisticated feedback channels, which makes it difficult to get proper feedback from all the customers in every phase of engagement. These channels could cover all stakeholders who are engaging with the customer – the distributor, underwriter, customer engagement team, and claims settler. These feedback data points then need to be incorporated in the advanced analytics of customers behavior to better understand their sentiments about the company. Also, the feedback could be utilized to devise improvements in the customer experience.

To conclude, the insurance industry is at an inflection point of customers engagement due to ever-evolving customer expectations and the increasing need of product innovation. Customer engagement innovation in the Insurance industry should focus on:

- Personalized engagement based on data driven insights

-

Improve digital presence by utilizing chatbots, Mobile Apps, and intuitive websites along with periodic updates/touch bases on

- Product performance

- Education on product benefits and other related services

- Personal life events such as birthdays, anniversaries, etc., and

- In-person interactions with customers through strategically located customer centres

The goal for Insurance companies should be to make interaction with customers more natural, constructive and enabling; less obligative; and less strenuous. In the wake of a new generation of customers in the developing and developed markets, it is imperative for Insurance companies to not only embrace the technology but also to increase the level of empathy for their customers.

-

EY Global Consumer Insurance survey 2014

↩